Many of the more experienced individuals in the industry may recognise the term ‘Deferred interest’ as it was commonplace during times of higher interest rates. As we see the highest interest rates for 15 years, lenders must look to ways of innovating products and offerings to meet the needs of borrowers.

What exactly is meant by Deferred interest? And why is it important in today’s market? Deferred interest allowed for cheaper monthly payments by allowing borrowers to delay in making interest payments on the loan for a set period of time. The lower mortgage payments meant that borrowers could meet affordability when they would otherwise be priced out the market.

No longer common place, but have Deferred interest products been replaced with Product fees? A product with a high upfront fee typically means a lower interest rate and then lower monthly repayments and increasing your chance to meet affordability set by lenders.

The industry is now seeing an increase in products coming to the market with a fee attached at the front-end, anywhere from 1.5% – 9.99%, but what is driving this demand for such products? Put simply, paying an additional fee can see you achieve a lower monthly payment, and help you to achieve the required affordability measure from the lender.

In a similar vein, paying a larger deposit can help achieve a more beneficial rate. Selecting a product with a lower loan to value can see a lower interest rate coupled with an arrangement fee. When selecting a higher fee, lower interest rate product, the lower monthly payments can help meet the affordability challenges we are currently seeing in the market. West One highlighted at the start of the year that Interest Cover Ratio (ICR) is the biggest Buy-to-Let challenge in 2023, and these affordability challenges look set continue into 2024. We must appreciate that interest rates may remain at similar levels for several years, with the Bank of England, commenting it will be 2028 before we see interest rates at 4%.

Although the idea of paying or adding a high fee at the start of a mortgage may be a daunting one, in many cases the client may not have any other options available.

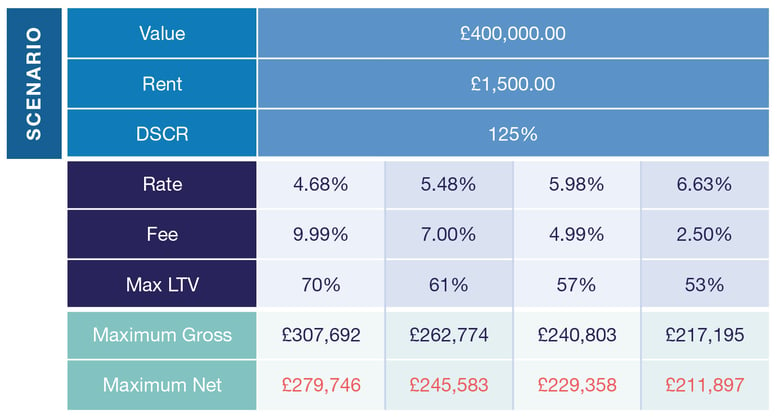

For example, if a client was looking to borrow £260,000 against a £400,000 property value, with rent of £1500PCM they have a number of options available from West One, using 5-year fixed rate options where the payrate is used in the ICR calculation:

The challenge though is that the standard product with the 2.50% fee only gives lending of £211,897 net, £48,103 less than they need. If this client is with a lender that offers no product transfer options, they are likely going to end up on SVR of 9%+ unless they can find the additional funds to put into the deal to make the low fee products available. By taking the higher fee options, they can achieve their goal and refinance at a much lower rate than the SVR they may end up on.

Higher fee products can also assist where the client is looking at finance on a lower rental yield property (particularly in the South East of England and London with yields at 2/3% typically) where standard fee products may limit their options to 40% LTV or less. The higher fee products with the lower interest rates providing more leverage when payrate is used in the ICR, may mean the client is in a position to raise additional funds on existing property, or put fewer personal funds into a new purchase.

There will be some negatives with product fees that need to be considered. The first and principle being the initial sum of money needed for the mortgage to be agreed, without this, borrowers may not meet eligibility to be approved by the lender.

Also, refinancing when the fixed term comes to an end may prove a challenge as the same product option may no longer exist. Borrowers could find themselves with the challenge of finding a new product if their current lender is not offering Product Transfer options.

Paul Huxter, Head of Clubs and Networks at West One comments: “We have entered a new era in the Buy to Let market where the increased interest rates have caused issues for new purchases, alongside increasing challenges for those coming off existing BTL deals, that were much lower interest rates than available today. These clients need the support of the lenders to help them to achieve what they are looking for, and this means looking at different ways to present products in a way to still pass the scrutiny of the affordability tests in the market today. 5% fees were a shock when first introduced but are now becoming the norm as it allows the lender to ‘slice’ the product differently, still achieving the same commercial terms but providing access to a lower interest rate to help clients pass the ICR test. As interest rates have continued to increase, putting pressure on lenders to increase the interest rates charged, even the 5% fee deals struggle to meet the clients’ requirements in areas of the country. High fees may not be palatable to all, but in some instances give the client the only choice available other than falling on to SVR, putting in additional funds themselves or selling up and leaving the market. Choice is key, it gives advisers the tools to open those discussions and give the client options that to this point have not been available.”

Product fees are not the solution to all affordability challenges, they will not suit the needs of all borrowers. But such products do demonstrate innovation from lenders who want to support and provide answers for borrowers who are being underserved by the high-street. For some borrowers to achieve property ownership, they may depend on products which help achieve affordability and criteria challenges. For lenders like West One, the high fee products present choice and options for clients to achieve what they need. As with all financial decisions, it is best to seek independent financial advice and considering all options before entering any agreements.